The motivation of the original portfolio analysis is financial. Basically, cash generation and cash usage are the two key elements in evaluation of a business or a set of businesses. Therefore, a business can be evaluated simply by how much cash it generates (or is expected to generate) and by how much cash investment is necessary.

Assuming that capital can be generated only from within the firm, it is clear that some long-term equilibrium should be attained between businesses that generate cash and businesses that require capital investments. In Markstrat, although additional budgets can be negotiated under certain conditions determined by the instructor, this assumption is correct. Budgets are to some extent a function of the net marketing contribution, and investments are permitted only within the constraint of the budget limit.

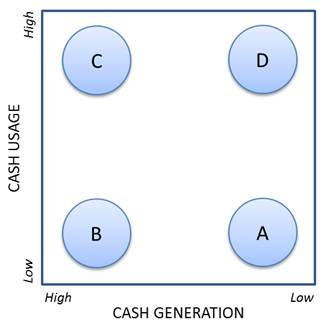

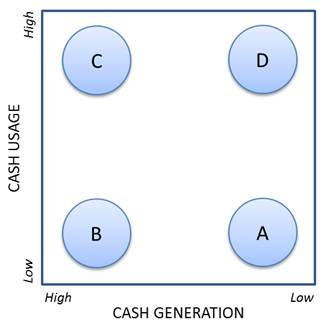

Figure 17 represents four businesses, corresponding to four extreme cases in terms of these dimensions of cash usage and cash generation. The horizontal axis represents the level of cash generated, and the vertical axis represents the level of investment required. Business A does not generate much cash, but does not require much cash either. From a financial point of view, it is not clear what use this business is to the company. Therefore, from a purely financial perspective, it should be eliminated. However, this business could have certain purposes. It could enable the company, because of its sales volume, to achieve greater economies of scale and/or benefit from greater experience (from an experience curve point of view). Consequently, it could reduce the cost of other businesses, which would become more attractive from this financial point of view. It could also be that this business contributes to the image of the firm or to its competitive position.

Figure 17 – The Cash Basis of Portfolio Analysis